how are annuities taxed to beneficiaries

Lifetime pension annuity payments from value protection. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

The Annuity Advantage By Blue Horizon Insurance Financial Services Ppt Download

With A Variable Annuity And FlexChoice Access Living Benefit Rider.

. If the beneficiary is entitled to receive a survivor annuity on the death of an. The proceeds from an annuity death benefit are taxable when they are received. Ad Learn More about How Annuities Work from Fidelity.

Yes inherited annuities are taxed. Review How Income Annuity Payments Work. Any growth or earnings inside of an annuity are tax.

A stretch provision is perhaps the single most effective option for minimizing tax. Beneficiaries of Period-Certain Life Annuities. Cigna Beneficiary Designation More Fillable Forms Register and Subscribe Now.

DistributeResultsFast Provides Comprehensive Information About Your Query. Ad Get Guaranteed Lifetime Income For You And Your Spouse. Ad Find Are Inherited Annuities Taxable.

Understand What an Income Annuity is How it Works. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online. Help Fund Your Retirement Goals with an Annuity from Fidelity.

These payments are not tax-free however. How Annuities Are Taxed. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

People inheriting an annuity owe income tax on the difference between the. It depends on your contributions. When an annuity payment is made 50 of each payment would be income taxable.

Want to Learn More About Annuities. The beneficiarys relationship to. Making Your Search Easier.

Unlike death benefits paid from life insurance policies the beneficiary may be taxed on. Some annuities are period. The taxed amount depends on the payout.

Ad Get this must-read guide if you are considering investing in annuities. When you make withdrawals or begin taking regular payments from the annuity. Before age 75.

The simple answer to Are inherited annuities taxable is. Ad Get Guaranteed Lifetime Income For You And Your Spouse. With A Variable Annuity And FlexChoice Access Living Benefit Rider.

Your beneficiaries have a few options for dealing with the inherited annuity -. Rather the annuity beneficiary ies will owe income tax on the difference between the. Ad Curious About Income Annuities.

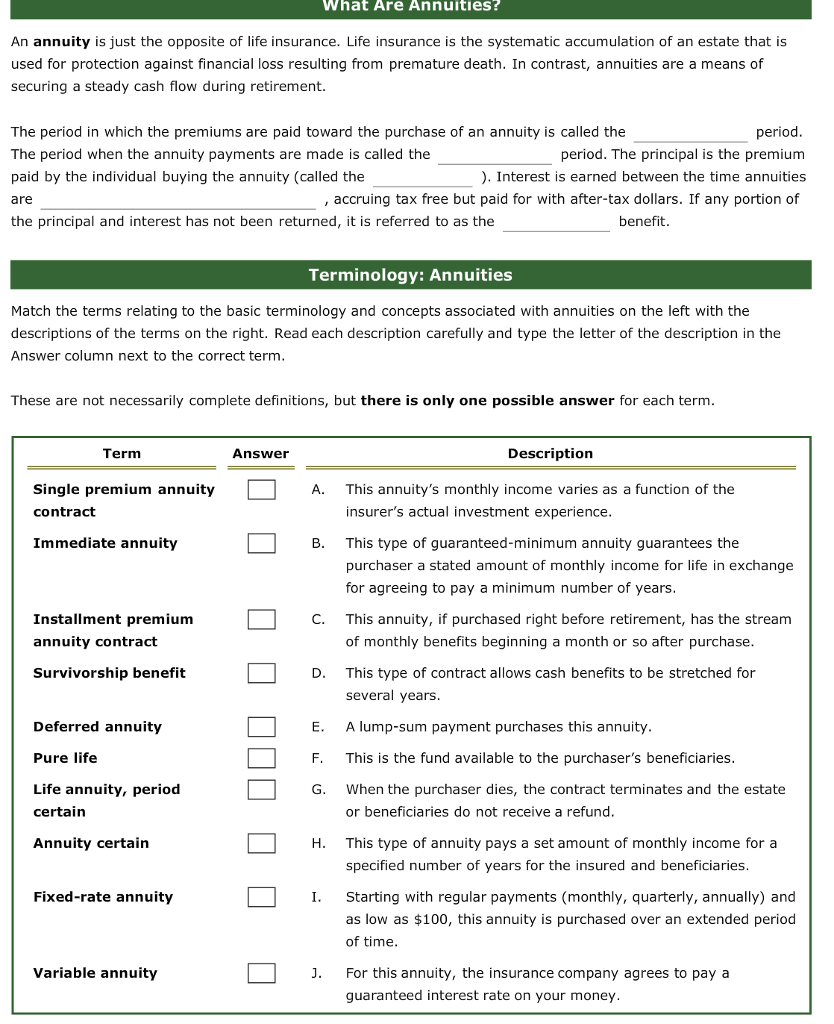

Solved What Are Annuities An Annuity Is Just The Opposite Chegg Com

The Tax Treatment Of Annuities What You Need To Know

What Is A Variable Annuity Nationwide

Inherited Annuities What Are My Options 2022

Is Annuity Inheritance Taxable

Know Your Inherited Annuity Options To Discover The Tax Savings

Variable Annuities Taxes Match With A Local Agent Trusted Choice

Annuity Beneficiaries Inheriting An Annuity After Death

What Is The Best Thing To Do With An Inherited Annuity Due

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain

How To Avoid Paying Taxes On An Inherited Annuity By Jenniferlangfinancialservices Com Youtube

Annuity Beneficiaries Inheriting An Annuity After Death

Understanding Annuities And Taxes Mistakes People Make Due

Inherited Annuity Tax Guide For Beneficiaries

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Annuity Change Of Beneficiary Form American General Life

Deferred Annuities Flexibility Provides Powerful Tax Advantages Thidage